Table of Content

- EMI Calculators

- How do I Improve My Chances of Getting a Home Loan?

- Checking your browser before accessing www.hdfcbank.com.

- Checking your browser before accessing leads.hdfcbank.com.

- How to Check Home Loan Application Status Online?

- How to Check HDFC Home Loan Application Status Via Web Portal?

- HDFC Bank Home Loan Customer Care Number

It is up to HDFC to assess your eligibility and ability to repay the EMIs for two home loans. Repayment of home loans is done through Equated Monthly Installments , which is a combination of interest and principal. In the case of loans for resale homes, EMI begins from the month subsequent to the month in which disbursement of the loan is done. In the case of loans for under-construction properties, EMI usually begins once the construction is complete and the house loan is fully disbursed.

A home loan provisional certificate is a summary of the interest and the principal amounts repaid by you towards your home loan during a financial year. It is provided to you by HDFC and is required for claiming tax deductions. If you are an existing customer, you can easily download your provisional home loan provisional certificate from our online portal .

EMI Calculators

The section labelled “Track Your Application” may be found on the following page. Your User ID and password, which were provided to you at the time of application, should be entered into the two fields below. On the next page, you can see the status of your application for a mortgage. Once you avail a HDFC home loan, you can access your home loan account online on our website. You can download account statements, interest certificates, request for disbursement and do much more. Credit Linked Subsidy Scheme under PMAY makes the home finance affordable as the subsidy provided on the interest component reduces the outflow of the customer on the home loan.

Longest loan tenure available across banks and NBFC’s in India for buying a home on a loan is around 30 years, subject to borrower’s current age and retirement age. Select the Submit button and the application status of your home loan will be displayed on the next page. Tracking your HDFC Bank home loan status online through its official website is a very easy procedure. One of the easiest ways to check the status of your Home Loan application is by just giving a call to a Fincity Home Loan representative.

How do I Improve My Chances of Getting a Home Loan?

You need to find ways to improve your credit score. By practicing financial discipline, you could show potential lenders that you are not a credit risk. You can also use HDFC home loan status tracker to view the status of your loan application. Now all you have to do is pay the processing fees and your online loan application is complete. HDFC has made it convenient for you to check your home loan status on the official mobile app. For this, you need to have your mobile number registered with the bank.

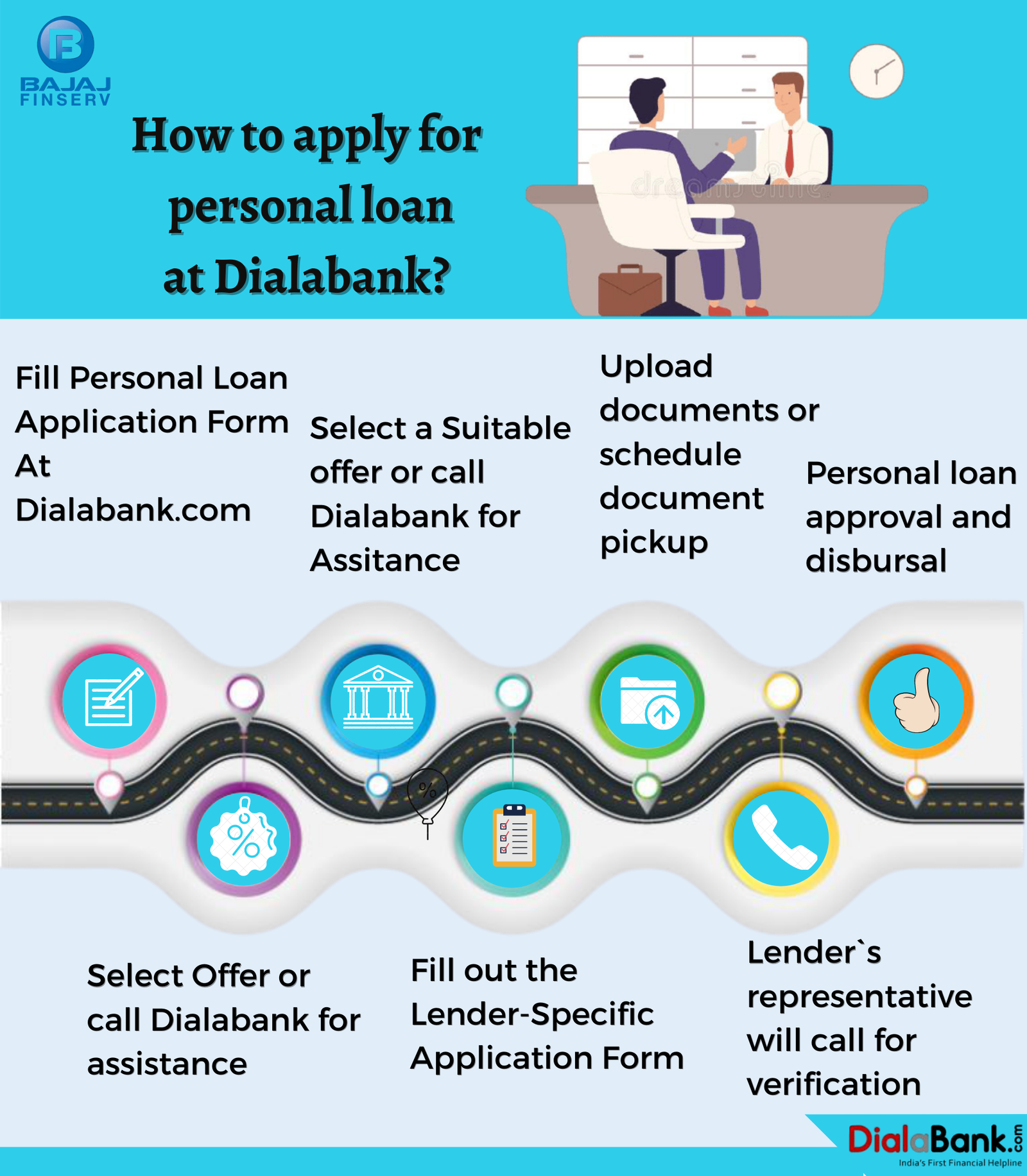

You will need to sign the loan agreement before the lender hands over the disbursement cheque to you. Make sure that you read the most important details such as interest rate, interest type, loan tenure, EMI, and other terms and conditions carefully before signing the loan agreement. HDFC’s home loan application process is easy and convenient. Here is a step-by-step guide to the home loan application and disbursement process.

Checking your browser before accessing www.hdfcbank.com.

At the same time, do an independent due diligence. Make sure you provide all the details that the home loan provider will need to process your application. You can now apply for a home loan online in 4 simple steps with HDFC’s quick and easy apply online module.

Obtain your credit report periodically, say once or twice in a year, verify the same for errors and get them rectified as and when required. If you are self-employed, in addition to the above information, we also assess the sustainability of business, and stability of cash flow. You can call on these numbers between 8 a.m. On all days including Sundays and bank holidays. You need to enter your mobile number to receive the verification code sent by the bank.

For Home Extension Loans, the maximum tenure is 20 years or till the age of retirement, whichever is lower. We are unable to show you any offers currently as your current EMIs amount is very high. You can go back and modify your inputs if you wish to recalculate your eligibility. This option provides you the flexibility to increase the EMIs every year in proportion to the increase in your income which will result in you repaying the loan much faster. Loans against property / Home Equity Loan for Business Purpose i.e. Generally co-applicants are close family members.

An HDFC home loan EMI calculator can come in handy to customers who wish to take a home loan from HDFC Bank. Make sure that you fill the online application form carefully and provide all the necessary details accurately. The contribution can be made by you upon opening an account with HDFC. The account opening process can be completed by submitting the application form along with the list of documents. A Permanent Retirement Account Number will be allotted to you through which you can start contributing to the NPS scheme to accumulate the corpus for retirement during working life.

Here, you will find two fields where you can enter your User ID and password which would be given to you at the time of application. After applying for the loan, you want to know the status of your application. Check your credit score regularly to identify errors and get the same rectified.

There are many reasons why your loan application could be rejected. The most common reason is poor credit history. If you have defaulted on your loan earlier, you are likely to have a low credit score. In this case, your loan application will be rejected by the bank.

Generally, co-applicants are close family members. Pre-EMI is the monthly payment of interest on your home loan. This amount is paid during the period till the full disbursement of the loan. Your actual loan tenure — and EMI payments — begins once the Pre-EMI phase is over i.e. post the house loan has been fully disbursed. SURF offers an option where the repayment schedule is linked to the expected growth in your income.

With minimal documentation, applying for a HDFC home loan is quick and hassle free. Our home loan experts are available to help you in your loan application process and offer you assistance every step of the way. If you have already applied for the loan, you can choose the personal loan option in this app and check your application status.

You can avail a higher amount of loan and pay lower EMIs in the initial years. Subsequently, the repayment is accelerated proportionately with the assumed increase in your income. You can download account statements, interest certificates, request for home loan disbursement and do much more. HDFC’s online home loans provide you the facility to apply for a home loan online from the safety and convenience of your home or office. I declare that the information I have provided is accurate & complete to the best of my knowledge.

No comments:

Post a Comment